The state currently has a nice rebate program and federal solar incentives and net metering are available but the last two are set to change soon.

Connecticut solar incentives 2018.

That is a homeowner who invests in a 5kw system would receive 2 315 right off the bat.

Rebate applications for 2020 rebates are being accepted and processed for payment.

Complete the application following the instructions on the rebate form and submit as directed.

Energy conservation loan program.

Connecticut kansas and michigan delivered setbacks.

Under a 2018 law connecticut will cease offering net metering for residential customers when its residential solar investment program expires in 2022.

2018 was a great year for solar with many noteworthy solar policy developments at the state level.

The expected performance based buydown epbb incentive provides you with an upfront cost reduction based on major design characteristics of your system such as panel type installation tilt shading orientation and solar insolation a measure of.

Rebate submission deadline extendedthe rebate submission deadline for services or equipment purchased and installed prior to december 31 2019 has been extended to september 30 2020.

California florida hawaii illinois massachusetts nevada new jersey new york and others.

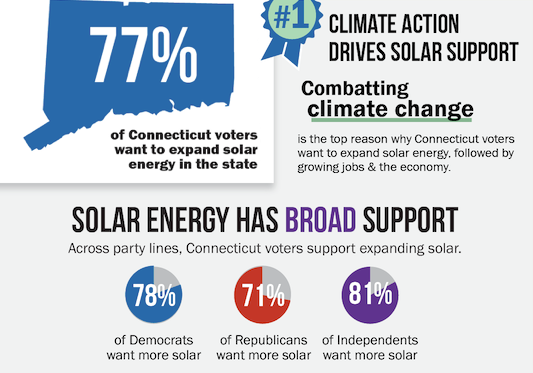

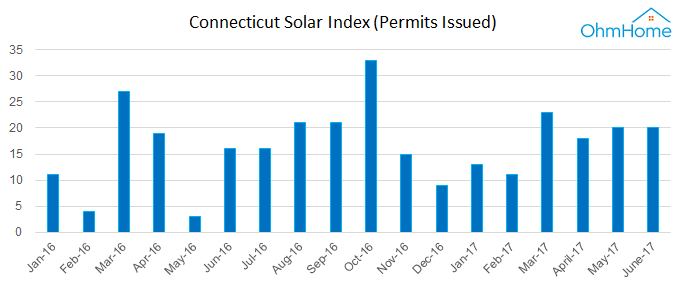

Connecticut solar power overview.

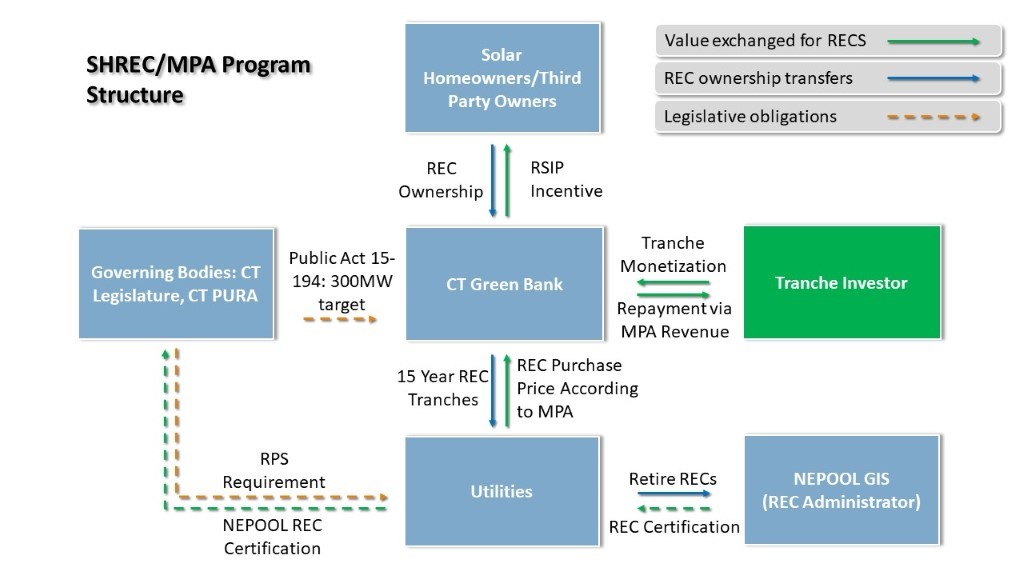

Officially known as the residential solar investment program and administered by the connecticut green bank this rebate is worth 0 463 per watt of solar installed up to 10kw.

Purchase a solar system for your home.

States with positive changes included.

A 2018 connecticut law that was designed to end net metering in the state was reversed before it had a chance to take effect according to an update from solarconnecticut.

Such incentives include rebates tax incentives and others that help reduce the up front cost of solar for potential buyers.

Even as federal tax credits are reduced from the current 30 percent down to 10 percent.

Connecticut solar group wins fight for transparency on value of solar study.

Connecticut is a great state for home solar for now.

In addition to connecticut s solar tax credits you d also be eligible for the federal solar tax credit 6 if you buy your own solar system outright currently the federal solar tax credit gives you a dollar for dollar reduction against your federal income tax equal to 30 of the final cost of solar energy systems you install on your home.

No additional steps are required.

How easy is that.

Federal solar tax credit.

In addition to the state incentives listed here connecticut residents should check with their local utility or installers about solar incentive programs and any changes made to them.