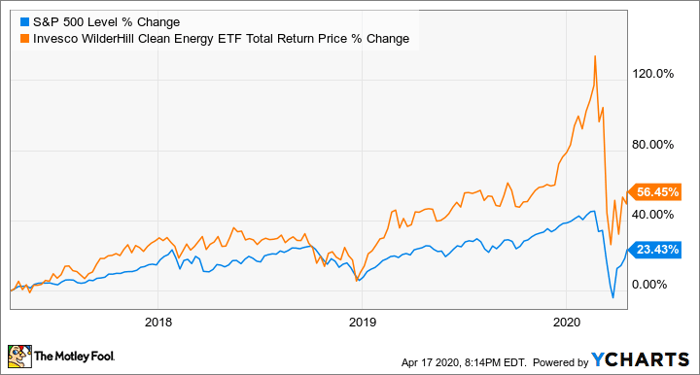

Begun on march 3 2005 the invesco wilderhill clean energy etf provides a unique way to play the clean energy industry because it focuses on clean energy companies using green and renewable.

Clean energy etf canada.

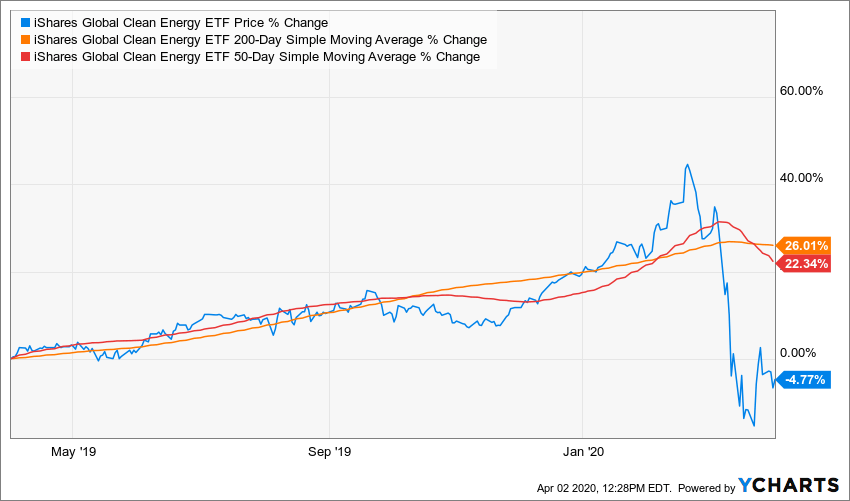

The largest renewable energy etf is the ishares global clean energy etf icln with 1 39b in assets.

This popular clean energy etf includes companies that specifically focus on solar energy and wind turbines.

Get detailed information about the ishares global clean energy etf etf including price charts technical analysis historical data ishares global clean energy reports and more.

Etf issuers who have etfs with exposure to clean energy are ranked on certain investment related metrics including estimated revenue 3 month fund flows 3 month return aum average etf expenses and average dividend yields.

In the last trailing year the best performing renewable energy etf was the qcln at 86 27.

Its investing space is diversified across.

The fund was launched in 2005 with 90 of its portfolio based on the wilderhill clean energy index.

Next is the invesco wilderhill clean energy etf pbw.

It has about 344 million aum and is currently trading at 11 03 per share.

These funds typically track the performance of an underlying index comprised of stocks of companies involved in clean and renewable energy sources.

It tracks the s p global clean energy index which is composed of 30 clean and renewable energy stocks from all around the world.

Below we examine the top 3 alternative energy etfs as measured by 1 year trailing.

The metric calculations are based on u s listed clean energy etfs and every clean energy etf has one issuer.

Clean energy etfs are exchange traded funds that invest primarily in stocks of companies involved in alternative energy sources such as solar wind and water.

He points to invesco global clean energy etf pbd a as an example of a fund that s well diversified across.